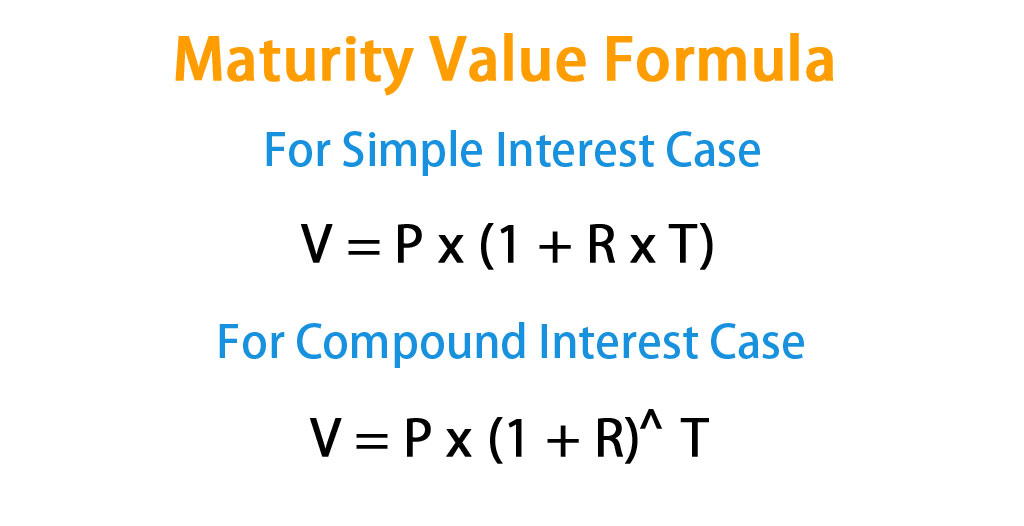

Maturity value formula

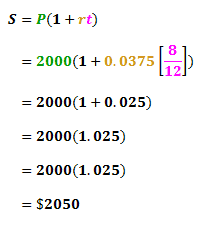

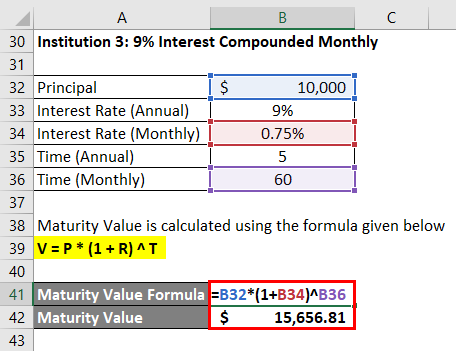

How to solve Maturity ValueFormulasA PIA PPrtA P1rtWhereinA - accumulate value or Maturity ValueP - PrincipalI - interestr - ratet - time. Equation for calculate maturity value is A P 1r n Where A Maturity value P Principal Amount r Rate of Interest i 400 n.

Calculting The Simple Interest And The Maturity Value Banker S Youtube

Final Maturity Value Formula FMV P 1 r n nt.

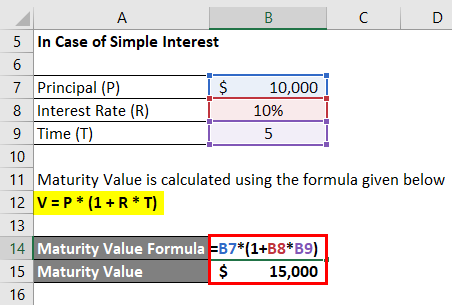

. The maturity value is the total of the original principal p plus interest value I due on the maturity date. The maturity value for the loan is given by the formula A P1 rt. Maturity Value Formula 1 V Maturity Value 2 P Principal Invested 3 R Rate of Interest 4 T Time of Investment.

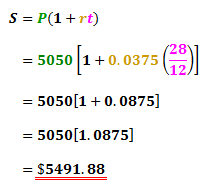

Accumulated value or future value of the original principle over a period of time. Maturity value Principal x 1 Rate x Time In this case we need to be sure that the annual rate of interest is adjusted for the fact that the note is shorter than a full year. You see that V P r and n are variables in the formula.

Maturity Value Calculator. What is the maturity value formula. Maturity Value is the estimated future benefit of the investment at its scheduled date of maturity.

Duration or Total Number. The actual maturity value will be as printed in your Fixed Deposit. Once you have that information use the formula V P 1 rn where P is the initial principal n is the number of compounding periods and r is the interest rate per.

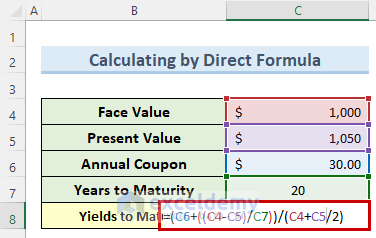

Maturity calculator is provided only as general self-help Planning ToolsInterest and Maturity Values are indicative only. Yield to maturity is considered a long-term bond yield but is expressed as an. Where Lumpsum Amount or Investment Amount P is the present value or principal amount to be invested.

What is maturity bond. Home Finance Interest. You see that V P r and n are variables in the formula.

The maturity value formula is V P x 1 rn. Face Value is a bonds maturity value or in other words the amount of money paid to the holder at. You see that V P r and n are variables in the formula.

Where F face value PV present value and n the number of periods. V is the maturity value P is the original principal amount and n is the number of. Updated on June 14 2022.

How to calculate maturity value. The maturity value formula is V P x 1 rn. Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures.

It is most often used to describe bank accounts. A bonds term to maturity is the period during which its owner will receive. V is the maturity value P is the original principal amount and n is the number of.

V is the maturity value P is the original principal. The maturity value formula is V P x 1 rn.

Dheeraj En Twitter Maturity Value Formula Definition Step By Step Examples Amp Calculation Https T Co Vhq2kufnlt Maturityvalue Https T Co Viuk8ghkb3 Twitter

Finding Maturity Value And Compound Interest Compounded Annually Number Sense 101 Youtube

Bond Pricing Formula How To Calculate Bond Price Examples

Tvoao9ik8pihsm

Maturity Value Formula Calculator Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

9 1 Markup On Cost Selling Price Price For Product Offered To Public Ppt Video Online Download

Calculate Maturity Value For A Simple Interest Account

Maturity Value Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Chapter 2 Pricing Of Bonds Ppt Download

Calculate Maturity Value For A Simple Interest Account

Finding Maturity Value Youtube

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

Simple Interest Finding Principal Rate Or Time 141 27 Youtube

Calculation Of Interest On Recurring Deposit Class 10 Maths Icse Youtube

Yield To Maturity Ytm Formula And Calculator